Branch Loan App Review: The Ultimate Guide to Quick and Easy Loans

Mar 19, 2015

Dec 27, 2023

6.0

4.74.1

10,000,000+

Images

Description

Branch Loan App is a personal finance app that provides access to instant loans with no physical documentation. It is a mobile solution transforming and changing how people borrow, save, and improve their financial lives. With Branch, users can apply for loans and receive funds directly to their bank accounts within minutes.

Branch offers loans with repayment periods ranging from 61 to 180 days and a maximum APR of 360%. The app is available on both Android and iOS platforms and has been downloaded by millions of users worldwide. Branch is an easy-to-use app that requires no collateral or credit history, making it accessible to a wide range of people.

Whether you need money for emergencies, unexpected bills, or to start a small business, Branch can help you get the funds you need quickly and easily. With its simple and secure interface, users can apply for loans, track their repayment schedules, and access financial education resources all in one place. Branch is committed to providing financial empowerment to its users, and its innovative lending approach is positively impacting people’s lives worldwide.

What is Branch Loan App?

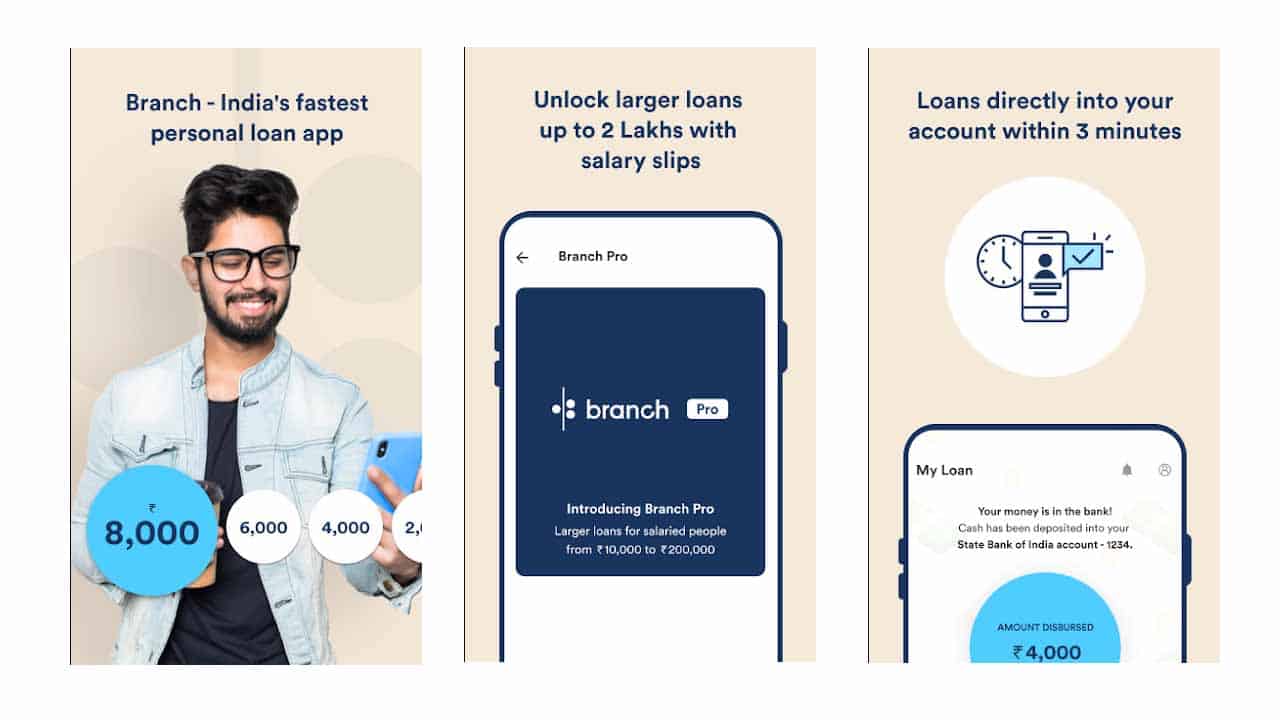

Branch Loan App is a personal finance app that provides access to instant loans with no physical documentation. It is a simple and secure way to borrow, save, and improve your financial health. The app was launched in 2015 and has since become one of the most common finance apps in Africa with better mass adoption compared to other lenders like the Fairmoney app.

The Branch Loan App allows users to request an advance on their paycheck through a feature called Pay, which may be a lower-cost alternative to a payday loan. The app also offers other loan products, including personal loans and business loans.

The loan application process is simple and straightforward. Users can download the app from the Google Play Store or the App Store and create an account. Once the account is set up, users can apply for a loan by providing basic information such as their name, phone number, and employment details. The app uses machine learning algorithms to analyze the user’s data and determine their creditworthiness.

Branch Loan App provides loans with a maximum APR of 360%, and repayment terms range from 61-180 days. The app also offers flexible repayment options, allowing users to pay back their loans in installments.

In summary, Branch Loan App is a personal finance app that provides access to instant loans with no physical documentation. It is a simple and secure way to borrow, save, and improve your financial health. The app offers a variety of loan products, including personal loans and business loans, with flexible repayment options.

Features of Branch Loan App

Instant Loans

One of the standout features of the Branch Loan App is the ability to access instant loans with no physical documentation. The loans are conveniently sent to your mobile money or bank account in minutes, making it an ideal solution for those who need quick access to funds.

Flexible Repayment Terms

The Branch Loan App offers flexible repayment terms that can be tailored to suit your needs. You can choose to repay the loan in weekly or monthly installments, and you can also choose the length of the repayment period. This flexibility makes it easier to manage your finances and ensure that you can repay the loan on time.

Low-Interest Rates

Compared to traditional payday loans, the Branch Loan App offers lower interest rates, making it a more affordable option for those who need to borrow money. Instead of paying traditional interest on the loan, you can leave a tip for the service. This can help you save money over the long term and avoid falling into debt.

Credit Score Tracking

The Branch Loan App also offers credit score tracking, which can help you monitor your credit score and identify areas where you need to improve. This can be a valuable tool for those who want to improve their credit score and access better loan terms in the future.

Referral Program

The Branch Loan App also has a referral program that allows you to earn rewards for referring friends and family to the service. This can be a great way to earn extra money and help others access the funds they need.

Overall, the Branch Loan App offers a range of features that make it a compelling alternative to traditional payday loans. With instant loans, flexible repayment terms, low-interest rates, credit score tracking, and a referral program, it’s a great choice for those who need to borrow money quickly and affordably.

How to Use the Branch Loan App

Downloading and Installing the App

The first step to using the Branch Loan App is to download and install it on your Android or iOS device. You can download the app from the Google Play Store or the iOS App Store. Once you have downloaded the app, follow the instructions to install it on your device.

Creating an Account

After installing the app, the next step is to create an account. Open the app and click on the “Create Account” button. You will be asked to provide your personal details, including your name, email address, and phone number. You will also be required to create a password for your account.

Applying for a Loan

To apply for a loan on the Branch Loan App, follow these steps:

- Open the app and log in to your account.

- Click on the “My Loan” button.

- Fill out the loan application form, providing all the necessary information.

- Submit your application and wait for approval.

Repaying a Loan

When it’s time to repay your loan, follow these steps:

- Open the app and log in to your account.

- Click on the “My Loan” button.

- Select the loan you want to repay.

- Choose your preferred repayment method and follow the instructions to make your payment.

Using the Branch Loan App is a straightforward process that can help you get the funds you need quickly and easily. Remember to provide accurate information when applying for a loan and make your loan repayments on time to avoid any penalties or fees.

Eligibility Requirements

The Branch Loan App is a popular option for those seeking a quick and easy way to obtain a loan. However, it is important to understand the eligibility requirements before applying for a loan through the app. Here are some of the key requirements:

- You must be at least 18 years old

- You must have a valid government-issued ID

- You must have a bank account

- You must have a mobile phone number

- You must have a stable source of income

One of the benefits of using the Branch Loan App is that it does not require a credit check. This means that individuals with poor credit scores may still be eligible for a loan. However, meeting the other eligibility requirements is essential.

It is important to note that eligibility requirements may vary depending on your location. Be sure to check the specific requirements for your area before applying for a loan through the Branch Loan App.

Overall, if you meet the eligibility requirements, the Branch Loan App can be a convenient and accessible way to obtain a loan quickly.

Pros and Cons of Branch Loan App

Pros

The Branch Loan App has several advantages, making it a popular choice for borrowers. Here are some of the pros of using the Branch Loan App:

- No credit check required: One of the biggest advantages of the Branch Loan App is that it does not require a credit check. This means that borrowers with poor credit scores can still qualify for a loan.

- Easy application process: The application process for the Branch Loan App is simple and straightforward. Borrowers can apply for a loan using the mobile app in just a few minutes.

- Fast approval and disbursement: Once a loan is approved, borrowers can receive the funds in their account within 24 hours. This makes the Branch Loan App a good option for borrowers who need cash quickly.

- No interest charges: Unlike traditional loans, the Branch Loan App does not charge interest on loans. Instead, borrowers pay a flat fee for the loan.

Cons

While the Branch Loan App has several advantages, there are also some drawbacks to consider. Here are some of the cons of using the Branch Loan App:

- High fees: The Branch Loan App fees can be higher than other loan options. Borrowers should carefully consider the cost of the loan before applying.

- Loan limits: The Branch Loan App has a maximum loan limit of $500. This may not be enough for borrowers who need a larger loan.

- Eligibility requirements: The Branch Loan App has several eligibility requirements for borrowers. For example, borrowers must have a regular source of income and a valid ID.

Overall, the Branch Loan App can be a good option for borrowers who need a small loan quickly and do not have good credit. However, borrowers should carefully consider the fees and eligibility requirements before applying.

Conclusion

Branch Loan App is a legitimate and reliable way to obtain quick loans without the need for physical documentation. The app is easy to use, and the loan application process is straightforward. With Branch Loan App, you can borrow money at a lower interest rate than traditional payday loans, making it a great alternative to consider.

One of the standout features of Branch Loan App is its flexibility. Depending on your needs, you can borrow as little as ₦1,000 and as much as ₦200,000. Additionally, the repayment terms are customizable, allowing you to choose a repayment period that best suits your financial situation.

Branch Loan App also offers a referral program that rewards you for inviting friends to use the app. For each successful referral, you earn a commission, which can be used to offset your loan balance or withdraw as cash.

Overall, if you’re looking for a quick and hassle-free way to get a loan, Branch Loan App is definitely worth considering. With its low-interest rates, flexible repayment terms, and referral program, it’s a great option for anyone in need of quick cash.

Related apps

What's new

Better than your bank - we've totally redesigned our app to help you manage your finances on the go. Update now to see our sleek new design and get access to new products and features.

If you like the new update, share the love by leaving a 5-star review and inviting your friends. Have feedback? Let us know by messaging Customer Care in the app.